Different ways of tax structuring in the case of an exit-related exchange of shares

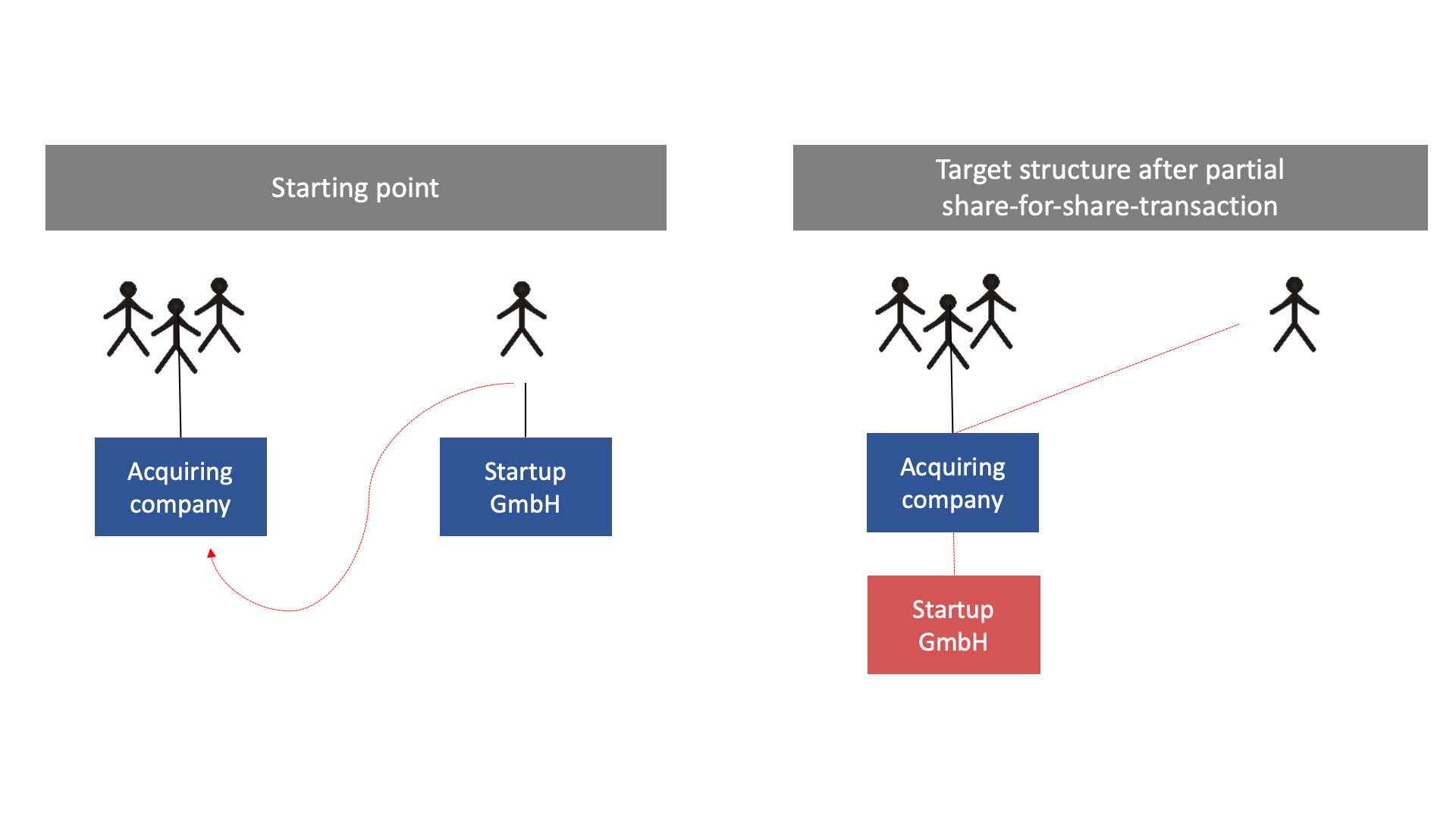

In the case of startup-exits, the prices for the sale of the shares can be quite considerable. These purchase prices are in general paid in cash by the buyer. Alternatively, it can also happen that in the course of the exit, shares in the acquiring company are granted in addition to cash. Such a partial share-for share-transaction can be illustrated as follows:

In the case of such an share-for-share-transaction, attention should be paid – as far as possible – to a tax-optimised structuring.

Qualified share transfers as a prerequisite

The primary objective of an exit-related share-for-share-transaction is to reduce the tax burden as far as possible or to wait until there is a sufficient inflow of liquidity. In the case of a qualified share-for-share-transaction, the benefits of the Reorganisation Tax Act can be claimed.

The prerequisite for this is that either a shareholding of at least 25% has to be transferred in the course of the share exchange or, in the case of small share transfers (< 25%), the majority of voting rights is provided to or extended for the acquiring company. However, the applicability of the Reorganisation Tax Act is generally independent of the amount of the shareholding, as the acquiring company usually wants to acquire all shares in the startup. In the case of share transfers of less than 25%, it is important to ensure that the timing of the transaction is structured accordingly (e.g. split transaction in which, from a timing perspective, sufficient shares are acquired in return for cash in a first step so that the acquirer can exceed the 50% threshold with the shares transferred as part of the share-for-share-transaction).

Founder holds his startup shares as private assets

If the founder directly holds the shares in his private assets and receives shares in a company as compensation in the course of an exit-related share-for-share-transaction, a tax-neutral way is possible, provided that an appropriate structuring takes place.

The situation becomes more complex in the case of cross-border exit transactions in which a settlement with shares in an acquiring company in the EU/EEA area or a third country is envisaged in the course of the exit. The reason for this is that a cross-border transfer of shares to a foreign company leads to a restriction of the right of taxation for Austria:

- In the EU/EEA case, an exchange of shares generally constitutes a taxable exchange transaction. However, at the request of the transferor, the tax determined can be postponed and is only triggered at the time of the sale of the new shares in the acquiring company. The current draft of the Tax Amendment Act 2022 (Abgabenänderungsgesetz 2022) is intended to adapt the regulation, among other things, to the effect that tax may be assessed in the event of the sale of the contributed shares if a relocation of the tax residency of the taxpayer takes place in this context.

Example:

Three persons each hold 33% of the shares in the start-up company. A German group intends to acquire all shares. The purchase price is to be paid 50% in cash and 50% through shares in the foreign buyer company (= share-for-share-transaction). In return, the existing shareholders are granted a 15% share in the German acquiring company. The previous shareholders of the start-up can file an application for non-assessment of the tax liability for the share exchange in their income tax return. If after three years the shareholding in the Austrian start-up is sold by the German acquiring company, this does not yet trigger any taxation for the former shareholders of the start-up. However, if after another year the 15% shareholding in the German acquiring company is sold, the previously unassessed tax liability becomes due.

- In the third country area, there are no tax benefits. An exchange of domestic shares for shares in an acquiring company domiciled in a third country results in immediate exit taxation (27.5%).

Summary

Regarding exit transactions of start-ups, there might be the case, that shares in the acquiring company are offered as consideration (= share-for-share-transaction) in addition to a cash payment. While such an exchange of shares within Austria and also within the EU/EEA area (under certain conditions) could be structured in a tax-neutral manner, there is immediate exit taxation in relation to third countries. For this reason, a preparatory tax analysis of the transaction structuring is important.

Authors:

Christoph Puchner, Managing Partner and Tax Advisor &

Bianca Habitzl, Tax Manager from ECOVIS Austria, one of the leading tax consultants in Austria in the startup sector.