Austrian Investing Report

New data - fresh insights - important trends

Published every two years, the study is considered one of the most in-depth analyses of the Austrian private capital market. It exclusively illuminates the perspective of private investors, a side of the startup ecosystem that is often neglected in public perception.

Our key findings

87.9%

typically make co-investments.

87.9% of all investors surveyed invest together with other investors.

+64%

see idealistic motives as an important investment motive.

64.8% of angel investors cite the joy of working with founders as one of their most important investment motives.

60%

expect positive effects from the red-white-red fund of funds.

60% of the investors surveyed see the red-white-red fund of funds as an effective instrument for improving investment conditions.

+80%

Angel investors have founded their own companies.

A sign of the high level of expertise in entrepreneurship among angel investors.

Professional experience

of the founding team

is the most important decision criterion for an investment for all investors surveyed.

AI & Big Data

as a top topic among investors

AI & Big Data, followed by Cybersecurity & Defense, and Healthcare & MedTech are the top topics in 2025.

+10%

in planned investment volume 2025

Investors plan to increase their average investment volume by 10% in 2024 compared to the previous year.

€225 million

in planned domestic investments 2025

Investors plan to invest approximately €225 million in Austria in 2025 – with a focus on startups and SMEs.

Our key findings

- Page 3

+10%

in planned investment volume 2025

Investors plan to increase their average investment volume by 10% in 2024 compared to the previous year.

€225 million

in planned domestic investments 2025

Investors plan to invest approximately €225 million in Austria in 2025 – with a focus on startups and SMEs.

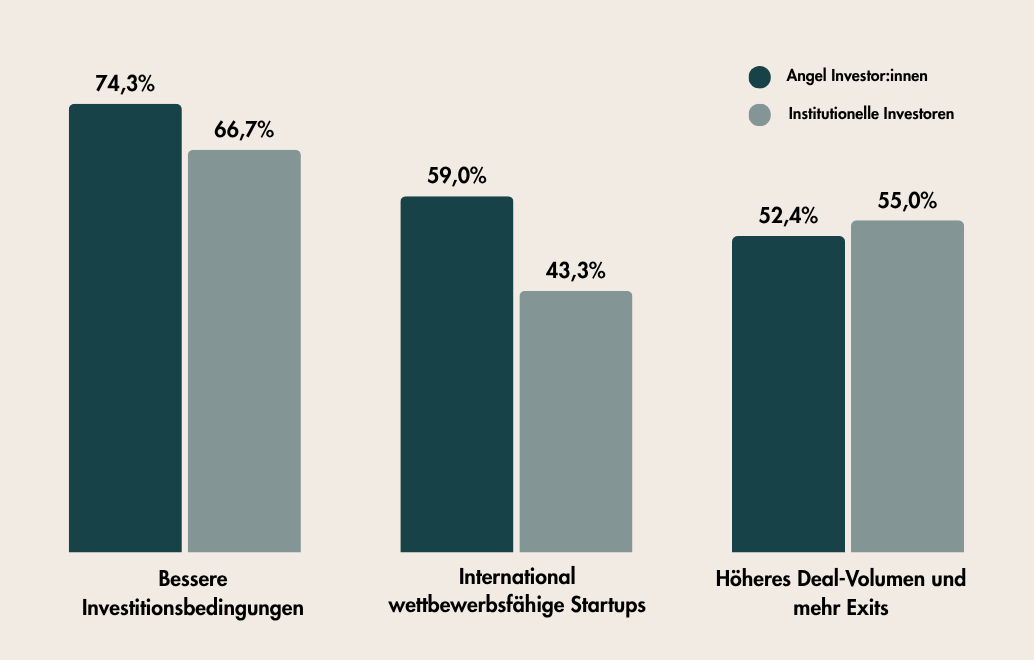

The effects of the red-white-red fund of funds

The red-white-red umbrella fund is not a state funding pot, but a market-based instrument. It mobilizes existing private capital and directs it into funds that invest in companies, thereby directly strengthening the region's capacity for innovation and growth. Investments in startups and SMEs create new jobs, advance technologies, and increase GDP in the long term.

The majority of investors surveyed see this as an effective solution to pool capital, diversify risks and promote professional investment structures.

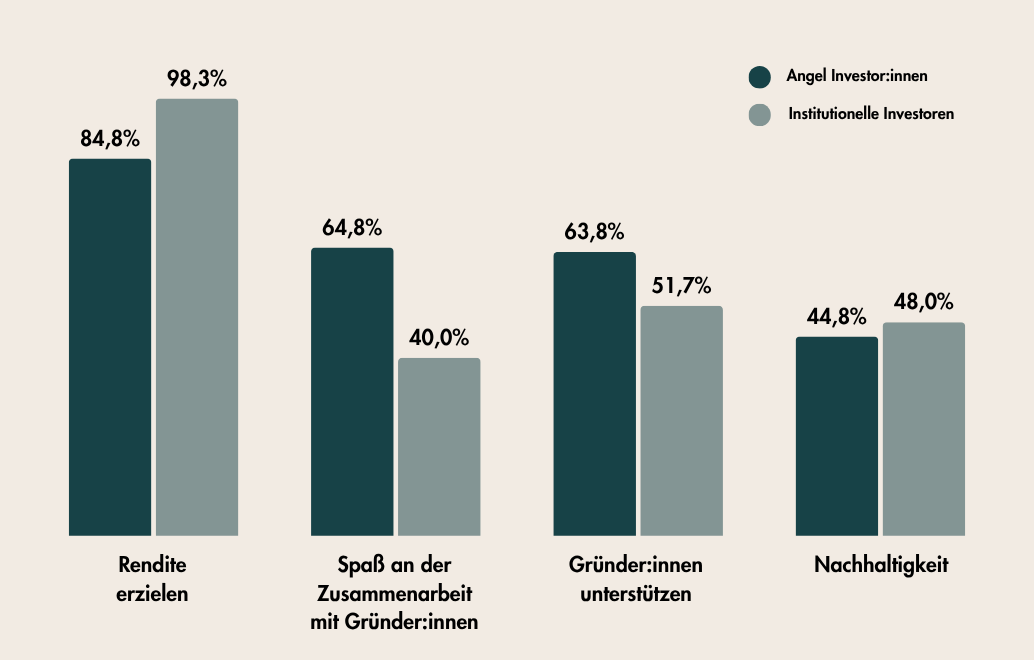

Key investment motives

Public perception is often one-dimensional: investments are seen as purely driven by returns. However, the results of this study reveal a much more differentiated picture: Private investors not only pursue financial goals, but also make a relevant social contribution through their commitment, particularly for innovation, entrepreneurship, and Austria as a business location.

While the expectation of return remains central, idealistic motives such as supporting founders or the joy of collaboration also play an important role for many investors.

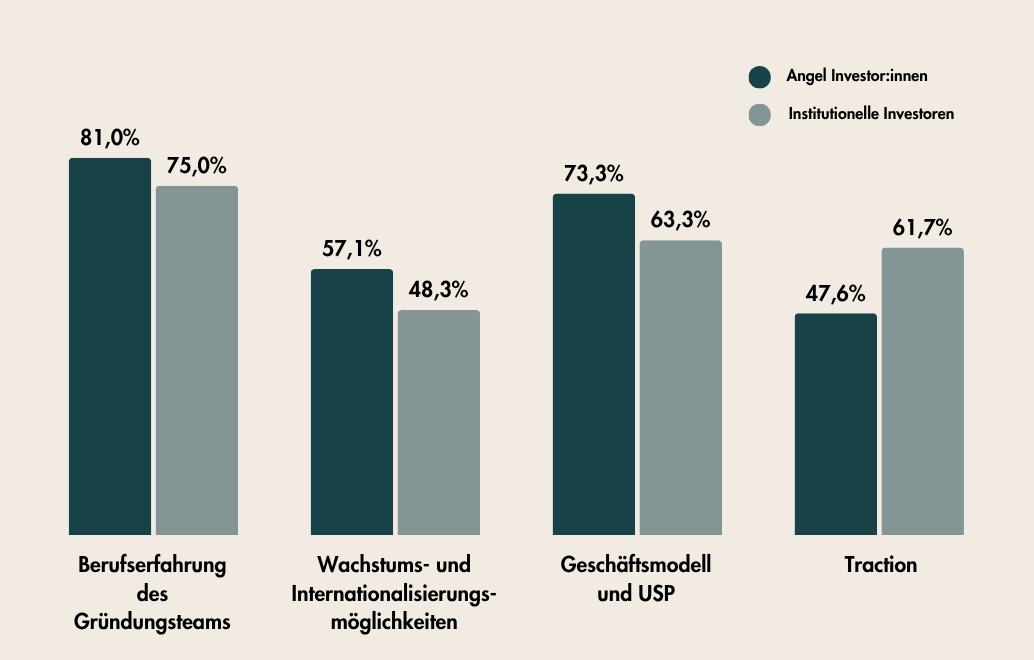

Selection criteria for investments

What do investors look for when selecting their investments?

The accompanying graphic makes it clear: For the vast majority, the professional experience of the founding team, a viable business model with a clearly identifiable USP, and growth and internationalization potential are what matter most. Initial market success (traction) also plays a key role.

Both groups pay particular attention to team quality and economic substance, with angels focusing more on growth potential and institutional investors on proven success.

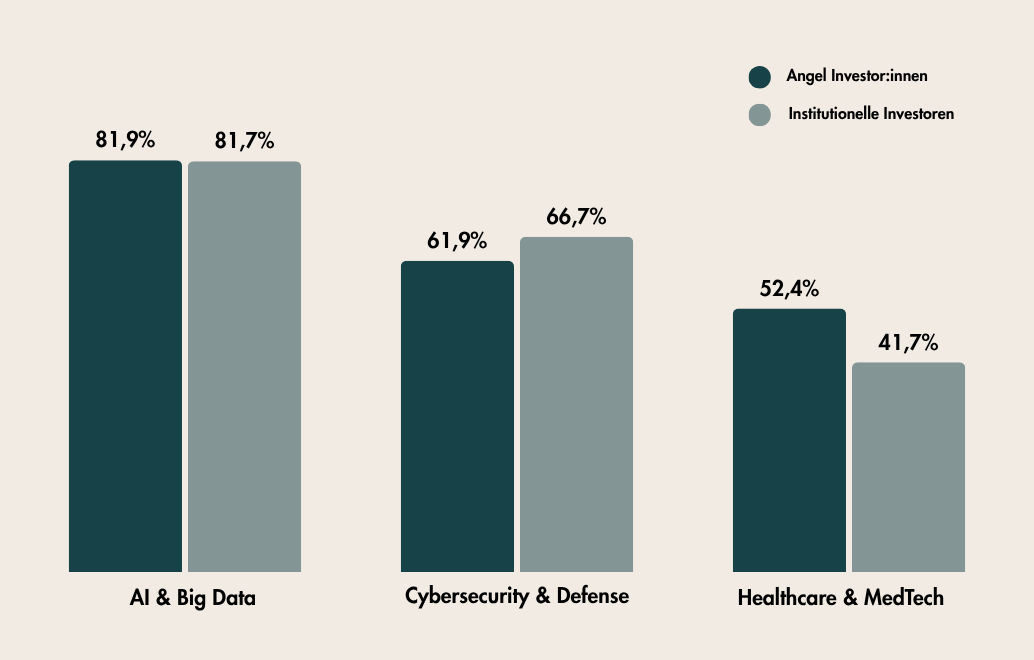

Top topics 2025

With 81.9% and 81.7% approval ratings, respectively, both investor groups rate Artificial Intelligence & Big Data as the key future area. Cybersecurity & Defense follows closely behind, having gained significantly in relevance compared to previous years. Healthcare & MedTech ranks third among the top investment themes.

This strong consensus among investor groups highlights the increasing consolidation of future technological themes: security, resilience, and AI-driven applications are clearly at the heart of strategic portfolios.

Our key findings

87.9%

typically make co-investments.

87.9% of all investors surveyed invest together with other investors.

+64%

see idealistic motives as an important investment motive.

64.8% of angel investors cite the joy of working with founders as one of their most important investment motives.

60%

expect positive effects from the red-white-red fund of funds.

60% of the investors surveyed see the red-white-red fund of funds as an effective instrument for improving investment conditions.

+80%

Angel investors have founded their own companies.

A sign of the high level of expertise in entrepreneurship among angel investors.

Professional experience

of the founding team

is the most important decision criterion for an investment for all investors surveyed.

AI & Big Data

as a top topic among investors

AI & Big Data, followed by Cybersecurity & Defense, and Healthcare & MedTech are the top topics in 2025.

+10%

in planned investment volume 2025

Investors plan to increase their average investment volume by 10% in 2024 compared to the previous year.

€225 million

in planned domestic investments 2025

Investors plan to invest approximately €225 million in Austria in 2025 – with a focus on startups and SMEs.

Us In Numbers

Use this space to promote the business, its products or its services. Help people become familiar with the business and its offerings, creating a sense of connection and trust.

30K

Item Title

+27%

Item Title

3M

Item Title

60%

Item Title

Austrian Investing Report 2024

Study on the status quo of the pre-IPO capital market in Austria

The Austrian Investing Report 2024 , published by invest.austria , is one of the most in-depth surveys of the domestic private capital market. Published every two years, the study exclusively examines the perspective of private investors—a central pillar of the Austrian startup ecosystem that has often been underrepresented in public perception.

Based on a survey of 165 investors, the report provides detailed insights into investment behavior, motives, deal structures, and future expectations. In total, the investors surveyed plan to invest around €225 million, with a significant portion of this flowing into startups, scale-ups, and innovative SMEs .

The report clearly shows that private investors make a decisive contribution to Austria's innovative strength and competitiveness . In a challenging economic environment, they assume responsibility, bear risk, and, together with founders, create the foundation for economic growth.

).png)

All Investing Reports

FAQs about the Investing Report

Funds of funds are investment funds that invest investors' money in shares of investment funds. The funds in which the fund of funds invests are called target funds. A fund of funds does not invest directly in companies.

.png)

.png)

.png)